Insights

UK Crypto Regulation: How We Got Here and What Lies Ahead

At Objectivus, we continuously monitor the evolving regulatory landscape, we are well placed to support you in meeting today’s compliance requirements and preparing for what lies ahead. Today we focus on the complexities of cryptoasset regulation. As global adoption grows, regulators have had to adapt quickly to the challenges posed by this rapidly advancing technology.

Cryptocurrency’s journey began in 2008 with the launch of Bitcoin, its technology sparking global interest and regulatory scrutiny. By 2013, the UK government began exploring its potential, and in 2017, the Financial Conduct Authority (FCA) issued early warnings on crypto risks, such as volatility and the lack of consumer protection. In 2018 the Cryptoassets Taskforce, comprising the FCA, HM Treasury, and the Bank of England, categorised cryptoassets and outlined their risks and benefits, laying the foundation for future regulation. In 2020, the UK adopted the 5th Anti-Money Laundering Directive (5AMLD), mandating FCA registration and AML/KYC compliance for crypto businesses. Regulation tightened further in 2021 with the ban on crypto derivatives for retail consumers and, in 2023, with stricter marketing rules. These developments signal the UK’s move toward greater oversight, consumer protection, and alignment with broader financial standards.

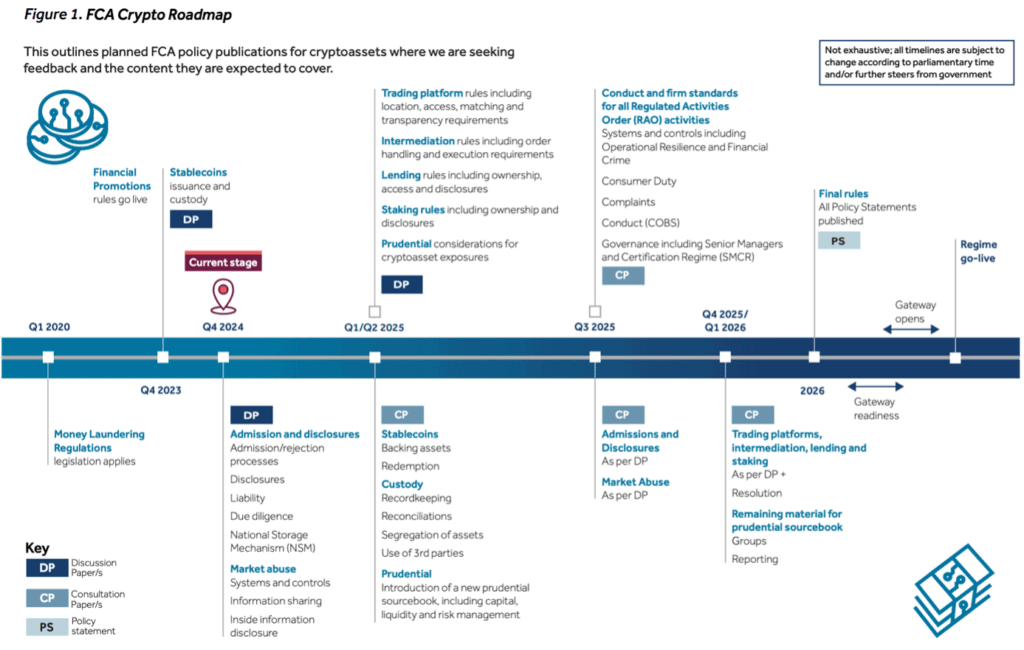

FCA Crypto Roadmap: What Lies Ahead

The FCA’s ongoing engagement with crypto regulation has culminated in a structured roadmap, outlined in Discussion Paper DP24/4. This marks a critical phase in the development of a robust framework for cryptoassets in the UK, the recent DP focuses on two core areas:

- Admissions & Disclosures (A&D) Framework

- Market Abuse Regime for Cryptoassets (MARC)

Takeaways from FCA Discussion Paper DP24/4

The FCA’s latest discussion paper, DP24/4, outlines proposals for regulating cryptoassets across two key areas: Admissions & Disclosures (A&D) and the Market Abuse Regime for Cryptoassets (MARC). These initiatives aim to develop a balanced framework that enhances market integrity, protects consumers, and prevents financial crime, while ensuring innovation is not unnecessarily hindered.

Under the Admissions & Disclosures Framework, the FCA proposes stringent standards for cryptoassets admitted to trading platforms. Issuers, or platforms (Cryptoasset Trading Platforms (CATPs)) in the case of decentralised assets, will need to provide clear and detailed admission documents, which will cover governance, risks, technology, and sustainability. To promote transparency, these documents will be stored in a National Storage Mechanism (NSM) in machine-readable formats. Platforms must also conduct thorough due diligence, including technology audits and issuer assessments, with the authority to reject assets deemed too risky. However, challenges remain, such as managing disclosures for decentralised assets like Bitcoin, where no identifiable issuer exists.

The MARC focuses on combating insider trading, market manipulation, and unlawful disclosures to strengthen market confidence. Explicit prohibitions on these activities will be tailored to the unique nature of cryptoassets, including a refined definition of ‘inside information’. Issuers and trading platforms must promptly disclose such information through accessible channels like websites or crypto-specific providers.

To address fragmented oversight, the FCA proposes solutions for cross-platform information sharing. These include bilateral data exchanges, common industry standards for APIs, multilateral systems operated by RegTech providers, or a unified industry-wide platform. Platforms will be encouraged to share data responsibly to identify and disrupt market abuse effectively.

Robust systems and controls will also be required, including real-time surveillance, on-chain and off-chain monitoring, conflict management, and employee training. Safe harbours will be introduced for legitimate practices, such as coin burning, under specific conditions.

The FCA recognises challenges, such as fragmented markets, information asymmetries, and technological complexities. By leveraging innovative RegTech solutions and fostering industry collaboration, the proposals aim to balance regulatory oversight with market growth.

These developments reflect the FCA’s commitment to creating a transparent, regulated market that supports both consumer protection and innovation. Feedback on DP24/4 will shape the next phase of regulation, ensuring a framework that is proportionate, effective, and future-proof. Comments on the paper are to be given before 14 March 2025.

The FCA delivered this DP to encourage conversation and thinking about the future of A&D and MARC regimes. Using the feedback to inform the development of a balanced regulatory framework aimed at addressing market risks without being a constraint on growth.

We will provide continuous updates on the FCA’s approach to regulating crypto with our next instalment in January. We hope you have found this useful and interesting as we move into another chapter of regulation. If there is anything from the content provided you would like to discuss, please to not hesitate to reach out at info@objectivus.com.